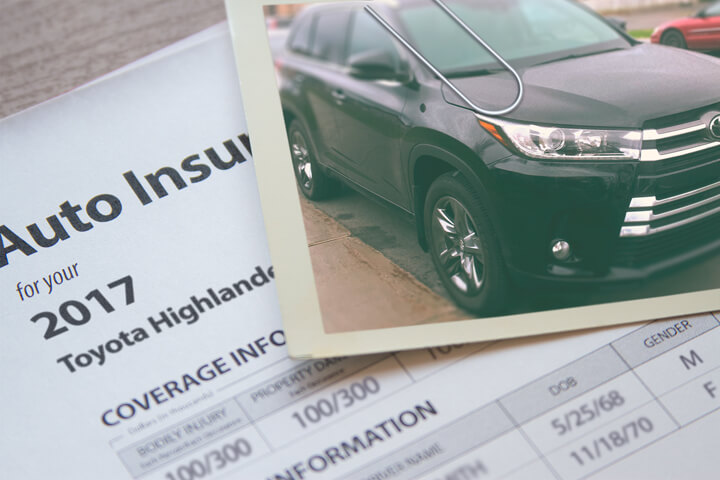

Toyota Highlander insurance cost image courtesy of QuoteInspector.com

Finding cheaper coverage for a Toyota Highlander in Pennsylvania is dependent upon lots of different factors such as annual miles driven, the likelihood of your vehicle being stolen, and any prior driving offenses you have. Drivers in Pennsylvania pay around $1,098 each year for Highlander insurance, but that figure is a projection based on a 30-year-old married male driver with full comprehensive and collision coverage and $250 deductibles.

It's highly likely you are not 30 and maybe not even a male, possibly single instead of married, or maybe you have a teen driver on your policy that needs to be considered. Just a very minor change in policy rating criteria or coverages could end up in a significant change in the policy rate.

Everone's needs are different, and this illustrates why the best method for finding cheap insurance rates for your Toyota is to compare as many rates as possible.

Click Here to Start Your Quote

The specific trim level tends to have a direct impact on the coverage cost, so the price you will be charged to insure a Highlander 2WD model will cost $220 less than the cost to insure the more costly Highlander Hybrid Limited 4WD trim level, as shown by the rates below.

| Model | Comp | Collision | Liability | Medical | UM/UIM | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|---|

| Highlander 2WD | $254 | $352 | $330 | $20 | $98 | $1,054 | $88 |

| Highlander 4WD | $288 | $428 | $330 | $20 | $98 | $1,164 | $97 |

| Highlander Sport 4WD | $288 | $428 | $330 | $20 | $98 | $1,164 | $97 |

| Highlander SE 2WD | $288 | $428 | $330 | $20 | $98 | $1,164 | $97 |

| Highlander Sport 2WD | $288 | $428 | $330 | $20 | $98 | $1,164 | $97 |

| Highlander Limited 2WD | $320 | $506 | $330 | $20 | $98 | $1,274 | $106 |

| Highlander SE 4WD | $320 | $506 | $330 | $20 | $98 | $1,274 | $106 |

| Highlander Limited 4WD | $320 | $506 | $330 | $20 | $98 | $1,274 | $106 |

| Highlander Hybrid 4WD | $320 | $506 | $330 | $20 | $98 | $1,274 | $106 |

| Highlander Hybrid Limited 4WD | $320 | $506 | $330 | $20 | $98 | $1,274 | $106 |

| Get Your Own Custom Quote Go | |||||||

Table data represents married male driver age 30, no speeding tickets, no at-fault accidents, $250 deductibles, and Pennsylvania minimum liability limits. Discounts applied include homeowner, claim-free, multi-vehicle, multi-policy, and safe-driver. Premium amounts do not factor in specific Philadelphia garaging location which can raise or lower premium rates noticeably.

Finding out which companies have the cheapest car insurance rates for a Toyota Highlander involves a little more sweat in order to find coverage that fits your budget.

Every car insurance company uses their own formula for setting rates, so let's look at the rankings for the car insurance companies that tend to be cheaper in Pennsylvania. It's important to know that Pennsylvania car insurance rates are calculated based on many things that can increase the price of coverage. Turning one year older, buying a home instead of renting, or having an at-fault accident can produce rate changes resulting in some rates now being more affordable than the competition.

Find Cheaper Car Insurance for Your Highlander

| Rank | Company | Cost Per Year |

|---|---|---|

| 1 | General Casualty | $726 |

| 2 | Travelers | $779 |

| 3 | USAA | $793 |

| 4 | Erie | $816 |

| 5 | Penn National | $840 |

| 6 | Auto-Owners | $973 |

| 7 | Amica | $1,012 |

| 8 | Atlantic States | $1,036 |

| 9 | Donegal Mutual | $1,069 |

| 10 | GEICO | $1,123 |

| 11 | Allied | $1,179 |

| 12 | California Casualty | $1,186 |

| 13 | State Farm | $1,210 |

| 14 | State Auto | $1,241 |

| 15 | Encompass | $1,357 |

| 16 | Progressive | $1,429 |

| 17 | Mutual Benefit Group | $1,439 |

| 18 | Harleysville | $1,452 |

| 19 | Nationwide | $1,491 |

| 20 | Chubb | $1,598 |

| Find Your Rate Go | ||

General Casualty quotes some of the best car insurance rates in Philadelphia at around $726 per year. This is $931 less than the average premium paid by Pennsylvania drivers of $1,657. Travelers, USAA, Erie, and Penn National also make the cut as some of the cheapest Philadelphia, PA car insurance companies.

As depicted above, if you currently buy coverage from Penn National and switched to Travelers, you might realize savings of about $61. Policyholders with Auto-Owners might save as much as $194 a year, and Amica customers might reduce prices by as much as $233 a year.

If you would like to find cheaper car insurance rates, click here to start a quote or quote rates from the companies below.

Remember that these policy prices are averaged across all insureds and vehicles and do not factor in a specific vehicle garaging location for a Toyota Highlander. So the insurer that can offer you the lowest price may not even be in the list above. That emphasizes why you need to quote rates from as many companies as possible using your own personal information and vehicle type.

Reckless driving habits raise car insurance rates

The obvious way to score good car insurance rates in Philadelphia for a Highlander is to be a good driver and have a clean driving record. The information below shows how violations and accident claims can impact insurance costs for different categories of driver ages. The information is based on a single female driver, full coverage, $250 deductibles, and no discounts are applied.

The data charted above shows the average cost of a car insurance policy in Philadelphia per year with no accidents and a clean driving record is $2,154. Get two speeding tickets and the average cost hikes up to $2,901, an increase of $747 each year. Then add in two accidents along with the two speeding tickets and the 12-month cost of car insurance for a Toyota Highlander goes up to an average of $5,500. That's an increase of $3,346, or $279 per month, just for not driving attentively!

Full coverage versus liability only rates

Buying cheaper car insurance is probably important to the majority of vehicle owners, and a great way to reduce the cost of insurance for a Toyota Highlander is to not buy comprehensive and collision coverage. The example below illustrates the comparison of insurance rates when comparing full coverage to liability only. The costs are based on a clean driving record, no claims, $250 deductibles, single marital status, and no policy discounts are applied.

If we average the cost for ages 20 through 70, physical damage insurance costs an additional $2,273 per year more than just insuring for liability. That raises the question if you should buy full coverage. There isn't a steadfast formula that is best for determining when to drop full coverage on your policy, but there is a general guideline. If the yearly cost of comp and collision coverage is more than around 10% of the vehicle's replacement cost less your deductible, then you might want to think about dropping full coverage.

For example, let's say your vehicle's replacement value is $8,500 and you have $1,000 deductibles. If your vehicle is totaled in an accident, the most your company would pay you is $7,500 after paying your deductible. If premiums are more than $750 annually for your policy with full coverage, then it might be time to consider dropping full coverage.

The agents below are willing to aid you in deciding which coverages you need, as some drivers aren't sure which coverage they need and prefer to get some professional input when trying to find lower insurance rates for a Highlander. It can be difficult to find the cheapest car insurance policy, and getting advice from a licensed agent can provide you satisfaction knowing your coverage gives you enough protection. To locate an agency nearest to you, click the button at the bottom.

- Les Moore - State Farm Insurance Agent

6750 N 5th St - Philadelphia, PA 19126 - (215) 224-4400 - Kowalewski Jawork Insurance Agency Inc

706 S 5th St - Philadelphia, PA 19147 - (215) 922-1222 - Trish Floyd - State Farm Insurance Agent

7706 Castor Ave - Philadelphia, PA 19152 - (215) 725-3000

More Philadelphia, PA insurance agents

How to find economical insurance for a Toyota Highlander

Lowering your rates is not difficult, and here are some of the recommended penny-pinching solutions that can help Philadelphia drivers find more affordable car insurance.

- Do not get tickets

- Do not get into accidents that are your fault

- Higher deductibles save money

- Pay lower rates with good credit

- Don't waste money on full coverage for older vehicles

- Drive safe vehicles

- Compare rates regularly and switch companies to save money

That last tip is remarkably vital, as was stressed in the prior article. Prices adjust frequently, so don't be tentative to buy from a new company if a cheaper price is available. Brand loyalty is great, but it's not a good idea if that loyalty ends up costing money that could be spent on other things. If you have a few minutes, compare rates and find cheaper auto insurance for a Toyota Highlander in Philadelphia.